VAT Increase for Hospitality Businesses

As businesses up and down the country progress on recovering lost trade, HMRC will be implementing the first phase of a VAT Increase for Hospitality

As businesses up and down the country progress on recovering lost trade, HMRC will be implementing the first phase of a VAT Increase for Hospitality

VAT : EU VAT Changes from 1st July 2021 New EU VAT Laws came into effect on 1st July 2021 and these are likely to

Tuesday, 13th April 2021 The New Tax Year has started, 6th April 2021 just in case you missed it! Which means there are a whole

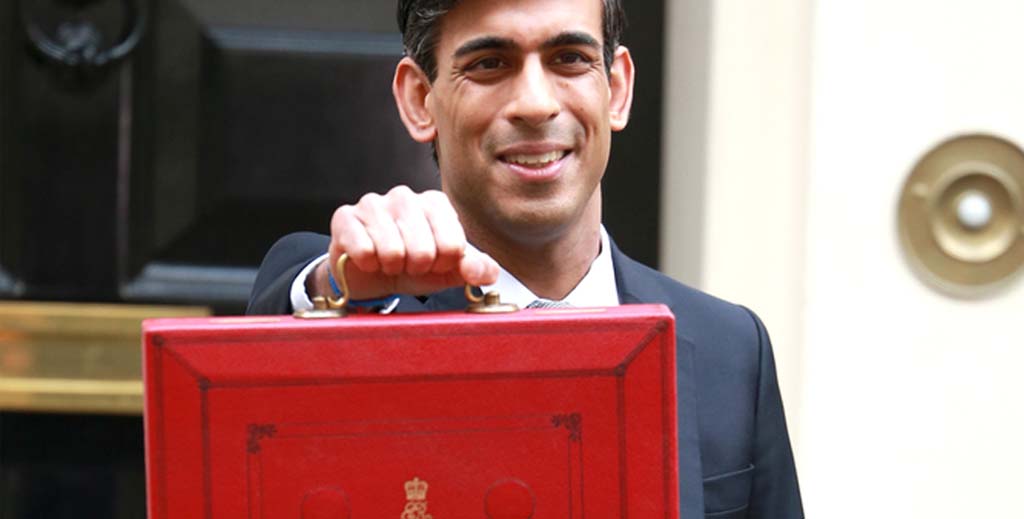

It has been 12 months since the country first went into lockdown due to Covid-19 and having already spent billions of pounds, Rishi Sunak pledged

Why do you need an EORI number You need an EORI number to move goods between Great Britain (England, Scotland and Wales) or the Isle of Man,

Friday, 17th July 2020 HMRC have already announced that everyone within Self-Assessment is eligible to defer their 2nd payment on account. What a better time

Wednesday, 8th July 2020 Today saw Rishi Sunak announce billions of pounds to help keep our businesses a float and support individuals like ‘soon to

Thursday, 11th June 2020 Next week will see many businesses coming out of lockdown, relaxing the opening rules enabling the new normal to become part

Thursday, 16th April 2020, Updated Monday, 20th April 2020 As announced by the Chancellor, in response to COVID-19 the coronavirus pandemic, the Coronavirus Job Retention

Tuesday, 14th April 2020 The New Tax Year has started, 6th April 2020 just in case you missed it! Which means there are a whole

© Copyright – Onyx Accountants | Disclaimer