Tuesday, 14th April 2020

The New Tax Year has started, 6th April 2020 just in case you missed it! Which means there are a whole host of new rates, allowances and reliefs. So what’s new for the 2020/2021 tax year?

How do these affect you, both business owners and individuals?

The Highlights

- Personal Tax, National Insurance and allowances

- Minimum Wage changes

- Company Cars, Vans and Fuel Benefit

- Student Loans

- Other personal tax reliefs and allowances

- Entrepreneurs Relief changes

- VAT, Corporation Tax, workplace pensions and allowances

Read on to find out more and how we at Onyx can help you make the most out of this year’s changes.

1 – Personal Tax, thresholds and allowances

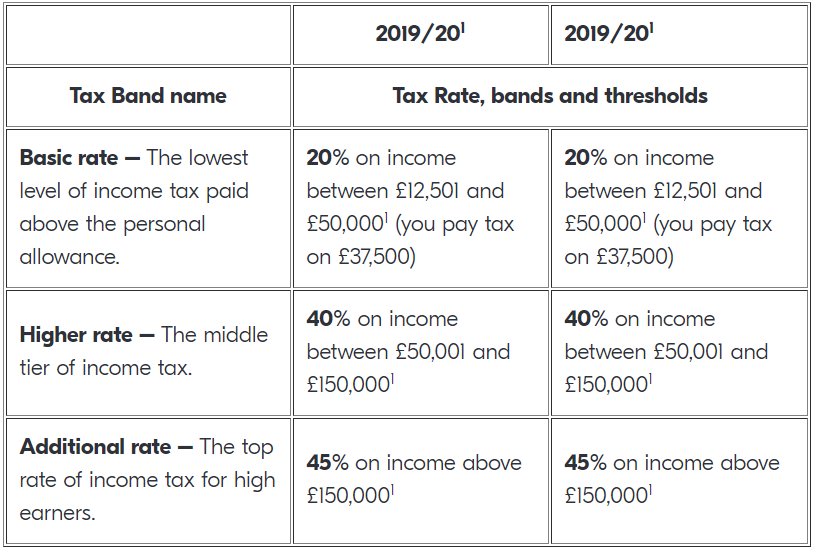

For the 2020/21 Tax Year both the Personal Allowance and threshold for paying the Higher Rate of income tax remain unchanged.

The Personal Allowance remains at £12,500 and the threshold for paying the Higher Rate of income tax (which is 40%) also remains at £50,000. This includes the personal allowance.

The Personal Allowance is reduced by £1 for every £2 earned over £100,000.

A table of the income tax rates for England and Wales is below. The rates are slightly different if you are a Scottish taxpayer1. If this is you, then contact us now to find out how your tax bill will be calculated.

Are you a director and shareholder of your own company? Contact Onyx now to find out how we can ensure you maximise on the tax efficiency of salary and dividends for this tax year.

Find out now if you could be at risk of being a higher rate taxpayer and what steps need to be taken to minimise the shock of a higher than expected tax bill and how to manage the cashflow.

National Insurance

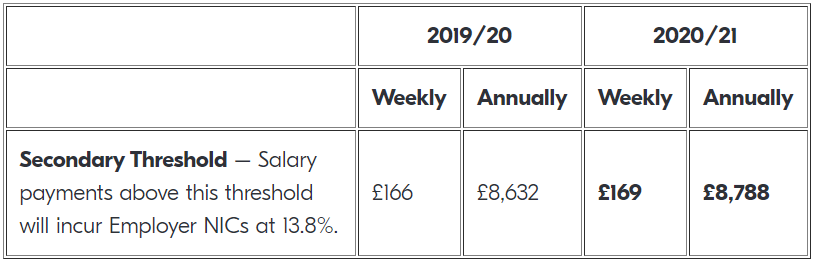

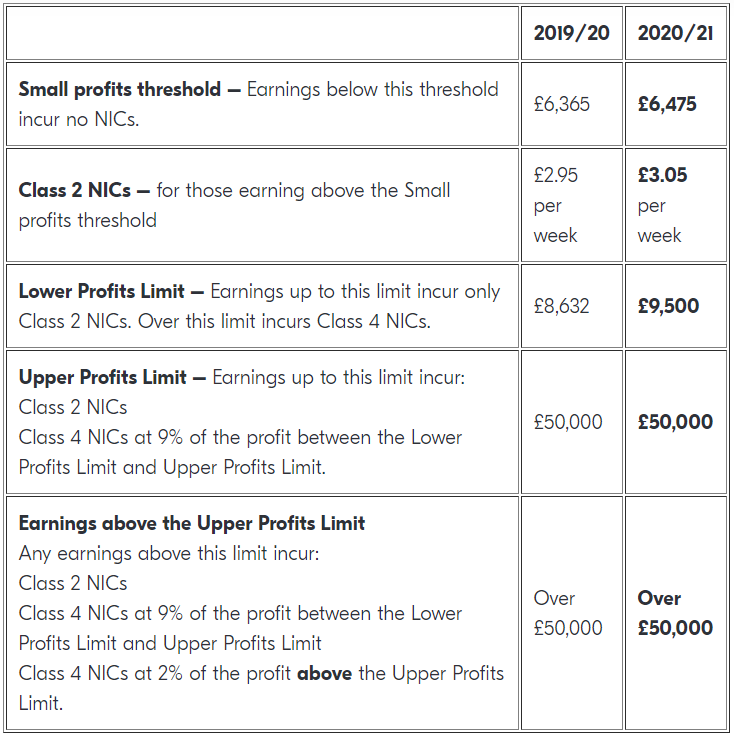

There are small increases to each of the income thresholds for both employee and employer national insurance contributions and for self-employed earnings. These are shown in the tables below:

– Employee National Insurance Contributions

– Employer National Insurance Contributions

As an employer, you may be eligible to claim Employment Allowance to reduce your Employer’s National Insurance bill.

– Self Employed National Insurance Contributions

Need help with your payroll calculations and want to ensure the correct amount of contributions are paid over, perhaps you are not sure how much you will pay on your self-employed earnings. Contact Onyx now and we will explain how these new rates will be applied.

Dividend Allowance

There is no change to the tax-free Dividend Allowance and the dividend tax rates in the 2020/21 tax year remain as follows:

- The tax-free dividend allowance is £2,000

- Basic-rate taxpayers pay 7.5% on dividends

- Higher-rate taxpayers pay 32.5% on dividends

- Additional-rate taxpayers pay 38.1% on dividends.

2 – National Minimum Wage and National Living Wage

The National Minimum Wage and National Living Wage amounts increase took effect on 1st April 2020. The minimum hourly rate that your staff are entitled to depends on their age and whether they are an apprentice. Follow the link to find out the more.

3 – Company Cars, Vans and Fuel Benefit

– Company cars

The benefit in kind (BIK) tax rates have increased for company cars.

The percentage applied to the list price of the car increases based on the CO2 emissions published by the Vehicle Certification Agency. HMRC has published a ready reckoner you can use to calculate your company car tax.

The tax rate percentage depends on when your car was manufactured, fuel type and CO2 emissions.

The cash equivalent fuel benefit charge has increased to £24,500 (from £24,100) and is calculated by using the same percentage used in the car benefit calculation.

– Company vans

The BIK fixed amounts for vans have also increased:

- The company van BIK increased to £3,490 (from £3,430)

- The fuel for a van provided for personal use increased to £666 (from £655).

Need help with your P11Ds or perhaps you are considering changing your company car or van and not sure how the new rates will affect the BIK? Contact Onyx now and we will explain how the new rates will affect your end of year tax bill including deductions via payroll.

4 – Student Loans

– Student Loan Plan 1 and Plan 2 threshold increase

The Department for Education has confirmed that from 6th April 2020 the earnings threshold before you start to repay a Student Loan for:

- Plan 1 loans has risen to £19,390 (from £18,935)

- Plan 2 loans has risen to £26,575 (from £25,725).

– Postgraduate Master’s Loan and Postgraduate Doctoral Loan (New)

This is new for the 2020/21 tax year. A Postgraduate Master’s Loan is a new type of loan introduced by the government to help with course fees and living costs while studying a postgraduate master’s course. The repayment of a Postgraduate Loan is treated the same as any other Student Loan and interest is charged from the day the first payment is received.

Repayment is calculated at 6% for students in England and Wales on income above £21,000. The rate is 9% for Scottish and Northern Ireland students with income above £18,330.

5 – Other personal tax reliefs and allowances

– Personal pensions

The tax-free amount you can pay into a Personal Pension remains at £40,000 for the 2020/21 tax year. The lifetime allowance for pension savings increased from 6th April 2020 to £1,073,100 (from £1,055,000 in the 2019/20 tax year).

– Capital Gains Tax

The Capital Gains Tax annual exempt amount for individuals increased to £12,300 for the 2020/21 tax year (the 2019/20 tax year allowance was £12,000).

There have been no changes to the capital gains tax rates for gains taxable in both the basic rate and higher rate tax bands.

6 – Entrepreneurs’ Relief

From 6th April 2020 the Entrepreneurs Relief lifetime allowance limit will be capped at £1 million. This is a significant reduction from the 2019/20 tax year when the limit was £10 million.

The capital gains tax rate remains unchanged at 10%.

Thinking about selling an investment property, other capital investments or perhaps you are considering a capital investment purchase? Contact Onyx now and we will discuss the options available to maximise on capital profits, utilise those potential losses and how to budget for the capital gains tax bill so there are no nasty surprises.

7 – VAT, Corporation Tax, workplace pensions and allowances

– VAT

VAT Registration Threshold – The level of revenue at which you must register for VAT remains unchanged at £85,000.

Standard rate of VAT remains at 20% and the Reduced rate of VAT remains at 5%.

– Corporation Tax

Corporation Tax payable on business profits remains unchanged at 19%.

– Workplace pensions (auto-enrolment)

There are no changes to the minimum amount you need to pay into your employee’s auto-enrolment workplace pension. This means the total amount of employer and employee contributions remains a minimum of 8% of your employee’s qualifying earnings.

– Annual Investment Allowance (AIA)

Companies will be able to claim £1 million as AIA for expenditure incurred between 1st January 2019 and 31st December 2020 on fixed assets such as plant and machinery. The allowance is expected to reduce to £200,000 on 1st January 2021.

– Business rates

The government is carrying out a fundamental review of Business Rates, with further consultation expected by Autumn 2020.

From 6th April 2020, businesses in the retail, leisure and hospitality sectors operating from premises with a rateable value of less than £51,000 will not pay any business rates in the year. This includes hotels, restaurants and coffee bars.

The discount that pubs receive on their business rates will increase from £1,000 to £5,000, as long as their rateable value is below £100,000 in England.

You can read further guidance in our Budget 2020 Report and also the latest COVID-19 news to ensure you are receiving the right financial support.

Not sure what you are entitled to or worried about how your business may be affected during the months ahead? Contact Onyx now.

Need help? Get in touch with Onyx

If you need help, or want to discuss further, please give us a call us or e-mail us at enquiries@onyxaccountants.co.uk for a FREE no obligation consultation.

Got any questions or queries? Our friendly team are happy to help. Just drop us a line! Call us on 0121 753 5522 or 01902 759 800.