SPECIALIST ACCOUNTANTS FOR CONSTRUCTION SECTOR

Get in touch with us for a FREE no obligation consultation

Providing accounting and financial services for businesses in the Construction Industry

Onyx Accountants service a wide variety of businesses within the construction industry from one man band builders to large contractors with 30+ employees.

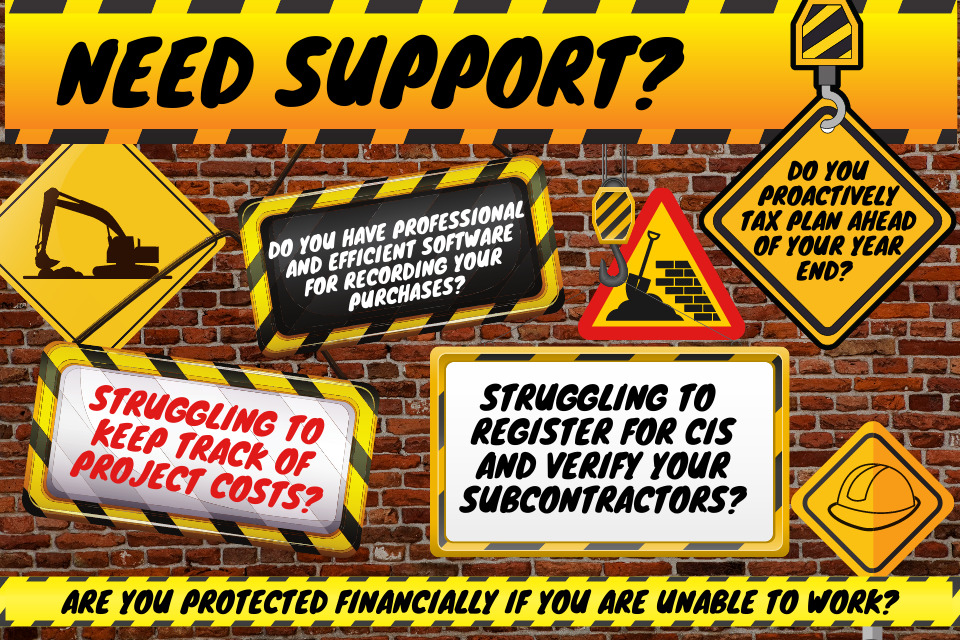

Our expertise in this industry allow us to provide you sound advice in which you can rely on to make sound business decisions. Whether it’s tax implications, HMRC compliance or construction accounting software we can offer a solution to any issues your business may be facing.

R & D Brochure

Construction companies are often required to develop a bespoke solution using a unique combination of different techniques and materials. Where solutions are created which are unique or not readily known to experts in the industry, qualifying R&D is likely to be taking place.

While HMRC statistics show many industries in the UK are waking up to the benefits of R&D tax credits, the potential is far greater in the construction industry.

Management Accounts Pack

It is important for businesses that are growing, or at a size where control is required to be up to date with both your business performance and the financial position your business is in. We have created a Management Accounts Demo pack which allows you to explore the level of reporting we can provide.

Trust and Availability

We understand working in the construction industry can have its pressures. At Onyx you can be sound in the knowledge that you have a dedicated team to cater to your every need. Each Onyx team is headed up by a qualified accountant and they are supported by a Client Manager and an Accounts Assistant. This allows you to have peace of mind that your work will be completed accurately and on time.

Statutory Compliance

We can help you by making sure accounts are prepared in the correct format, statutory books and other company secretarial records are kept up-to-date and that all statutory returns are prepared, We will ensure that contractors, sub-contractors, and the organisations that employ them, are engaged correctly and that IR35 and VAT compliance, HMRC and national insurance registration, and appropriate tax returns are correctly filed. Our experienced team will relieve you of the regulatory burden and leave you more time to concentrate on your core business activities. For more info please visit our Compliance Services page.

Budgeting and Reporting

Every organisation should plan ahead to ensure success but daily business pressures often conspire to delay the strategic planning process. Supported with the correct construction accounting software, we can provide monthly or quarterly reporting packs tailored to your business which will keep you on track. Subsequently this will allow you to see if a project is still feasible or if project costs are running out of control before it’s too late, or if you have any bad payers which are holding up funds.

“As a fast-paced business with year-on-year growth, it is sometimes easy to overlook or take financials for granted as to good and bad payers, payment terms and how this has positive and adverse effects on overall business financials. Onyx have helped centralise this info which has enabled us as a business, to make informed decisions on which clients to grow with, continue with or cease trading with based on their track record.”

Richard Hubball

Director of Technicare LTD

These reporting methods will give you the confidence to invest in any new growth plans such new sites, hiring extra staff or buying equipment, and will also avoid any hidden scares at the end of the year.

To read more about our reporting packages please see our Management Accounts page.

Payroll Services

Running a payroll can be time consuming, complicated and divert resources from the core activities of your business.

We can offer a Construction Industry Scheme compliant payroll service that ensures that people are paid in accordance with the regulations set out by HMRC whilst maximizing tax saving opportunities. We offer cost-effective solutions and provide an end-to-end payroll service, whatever the size or complexity of your business. For more info please our dedicated Payroll Bureau Services page.

Tax Planning

No matter the size of your business we will help you to understand the tax implications of your actions, in order that you can plan ahead and conduct your affairs in a tax efficient way. We will ensure you are making the most of any tax saving opportunities such as Capital Allowance claims, Research and Development tax credits, and also grant funding.

We can also look into your personal investment portfolio’s which will naturally come with tax implications and ensure you fully understand every aspect and again, see where savings can be made.

Interested to hear about how we have helped a client of ours with an R&D claim? Please click here to find out more.

Bookkeeping and Software

Ensuring you are following the correct bookkeeping practices and have the correct software in place to record your transactions is very important, especially when you have multiple projects running at the same time. We offer construction accounting software training on a range of bookkeeping packages.

Our team are available to help support you and give training sessions at your convenience. We are accredited partners with: Kashflow, Dext, Sage, Xero and Quickbooks. We are able to provide the complete service, whatever the size or complexity of your business, or simply provide support when needed.

For more information on the different package options please see our Accountancy Software Training Services page.

Contact us now for a free no obligation consultation