SPECIALIST ACCOUNTANTS FOR THE BEAUTY AND COSMETICS SECTOR

Get in touch with us for a FREE no obligation consultation

Providing accounting and financial services for businesses in the beauty and cosmetics industry

Onyx are specialists in providing accounting and financial services for businesses in the Beauty and Cosmetics industry.

We have a range of clients from beauty salons to aesthetic clinics and beauty product suppliers which has given us experience in solving any issues a business in this industry may face.

Case Study

R & D Brochure

The cosmetic and skincare industry is highly competitive and as such, companies in this marketplace are constantly engaged in efforts to improve their competitiveposition. Many companies are conducting qualifying R&D activities for R&D tax relief purposes in this sector on a daily basis, without even realising it. What may seem as typical day-to-day challenges in the office and field may qualify. This may include developing new products, processes or services or duplicating existing products and processes in an appreciably improved way.

Management Accounts

It is important for businesses that are growing, or at a size where control is required to be up to date with both your business performance and the financial position your business is in. We have created a Management Accounts Demo pack which allows you to explore the level of reporting we can provide.

Trust and Availability

At Onyx you can be sound in the knowledge that you have a dedicated team to cater to your every need. Each Onyx team is headed up by a qualified accountant and they are supported by a Client Manager and an Accounts Assistant. This allows you to have peace of mind that your work will be completed accurately and on time.

Statutory Compliance

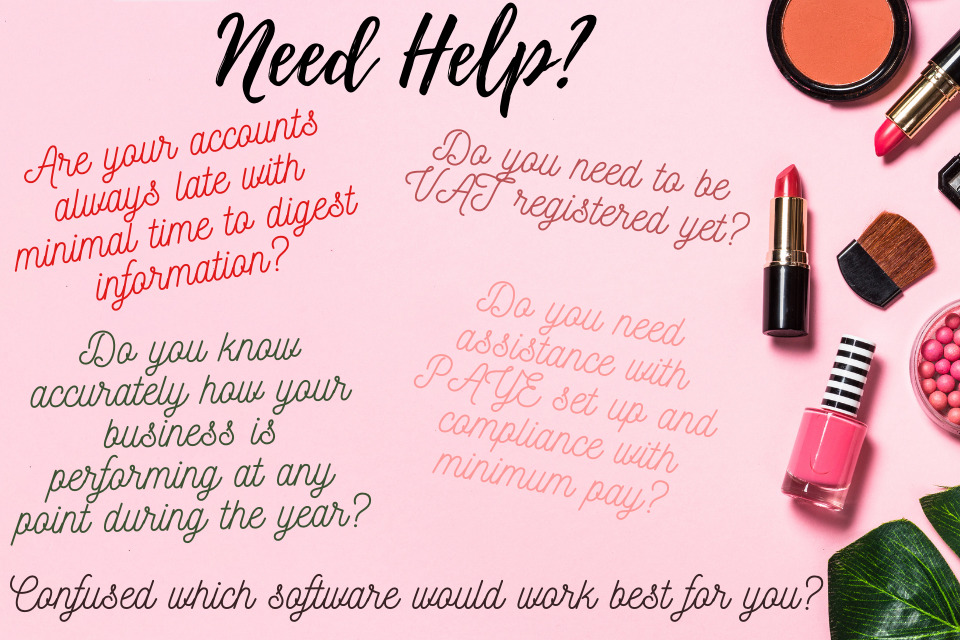

We can help you by making sure accounts are prepared in the correct format. Statutory books and other company secretarial records are kept up-to-date and all statutory returns are prepared. We will ensure that VAT compliance, HMRC and national insurance registration, and appropriate tax returns are correctly filed. Our experienced team will relieve you of the regulatory burden and leave you more time to concentrate on your core business activities. For more info please visit our Compliance Services page.

Budgeting and Reporting

Onyx can provide monthly or quarterly reporting packages tailored to your business. This will allow you to better measure your profit margins and losses at that specific point in time which will give you a higher level of financial control and understanding of the long-term cash needs of your business. These reporting methods will give you the confidence to invest in any new growth plans such as new treatments, hiring extra staff or buying equipment, and will also avoid any hidden scares at the end of the year.

“You can see the progress you are making within your business and adapt accordingly not have a big panic at the end of the year.”

Emma Johnson

To read more about our reporting packages please see our Management Accounts page.

Payroll Services

Running a payroll can be time consuming, complicated and divert resources from the core activities of your business.

We ensure that the regulations set out by HMRC are being complied with whilst maximizing tax saving opportunities. We offer cost-effective solutions and provide an end-to-end payroll service, whatever the size or complexity of your business.

For more info please our dedicated Payroll Bureau Services page.

Tax Planning

No matter the size of your business we will help you to understand the tax implications of your actions, therefore you can plan ahead and conduct your affairs in a tax efficient way. We will ensure you are making the most of any tax saving opportunities such as Capital Allowance claims, Research and Development tax credits, and also grant funding.

We can also look into your personal investment portfolio’s which will naturally come with tax implications and ensure you fully understand every aspect and again. As a result we can see where savings can be made.

Interested to read about how we have helped a client of ours with a Research and Development claim? Please read more here.

Bookkeeping and Software

Ensuring you are following the correct bookkeeping practices and have the correct software in place to record your transactions are very important. We offer software training on a range of bookkeeping packages. Our team are available to help support you and give training sessions at your convenience.

We are accredited partners with: Kashflow, Dext, Sage, Xero and Quickbooks. We are able to provide the complete service, whatever the size or complexity of your business, or simply provide support when needed.

For more information on our software packages please see our Accountancy Software Training Services page.

Contact us now for a free no obligation consultation