Waste Management & Recycling

Friday, 5th February, 2021 WASTE MANAGEMENT & RECYCLING – DON’T WASTE YOUR OPPORTUNITY TO CLAIM R&D TAX RELIEF! If you have forked out for the

Friday, 5th February, 2021 WASTE MANAGEMENT & RECYCLING – DON’T WASTE YOUR OPPORTUNITY TO CLAIM R&D TAX RELIEF! If you have forked out for the

Why do you need an EORI number You need an EORI number to move goods between Great Britain (England, Scotland and Wales) or the Isle of Man,

Thursday, 26th November 2020 The government has released the full details of the third SEISS grant to support self-employed people affected by the coronavirus. The

Thursday, 5th November 2020 The 2nd National Lockdown started on Thursday 5th November . This means further News and Updates for everyone who will be

Friday, 23rd October 2020, updated 5th November 2020 The government has announced that it will make available an SEISS Grant Extension to help support those

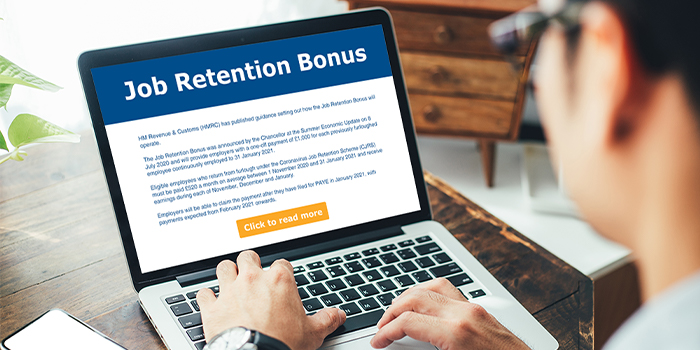

Friday, 16th October 2020, updated 22nd October 2020 We are pleased to announce our COVID 19: Payroll Update! This will impact on many employers and employees up

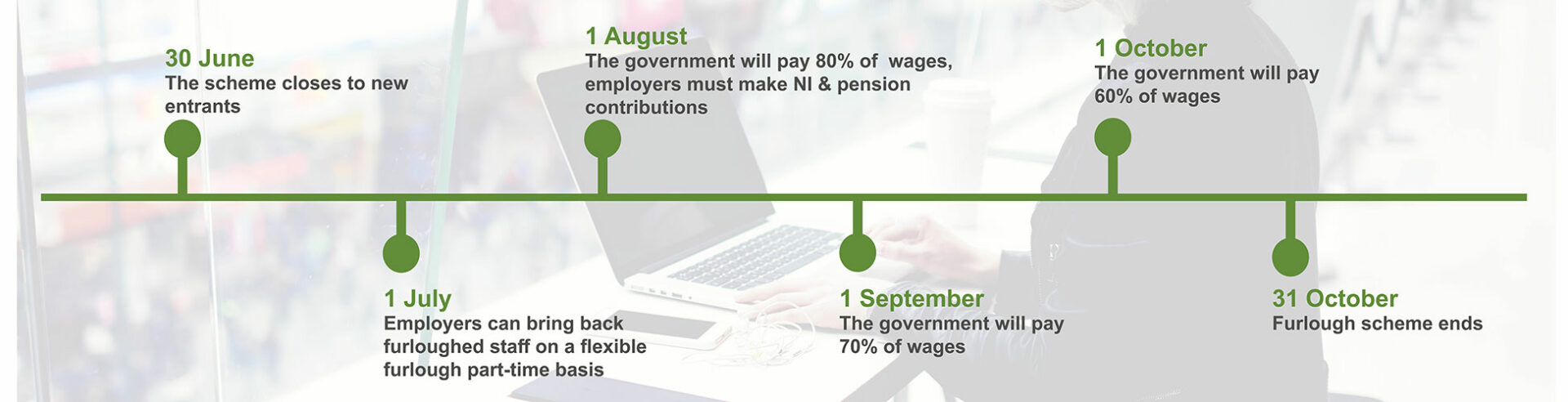

Friday, 25th September 2020 On Thursday, 24th September 2020 the Chancellor Rishi Sunak presented the UK Government’s Winter Economy Plan. This outlines the next stage

Wednesday, 23rd September 2020 The government have set aside £2bn of funding specifically for this new Kickstart Scheme. This could mean thousands of new jobs

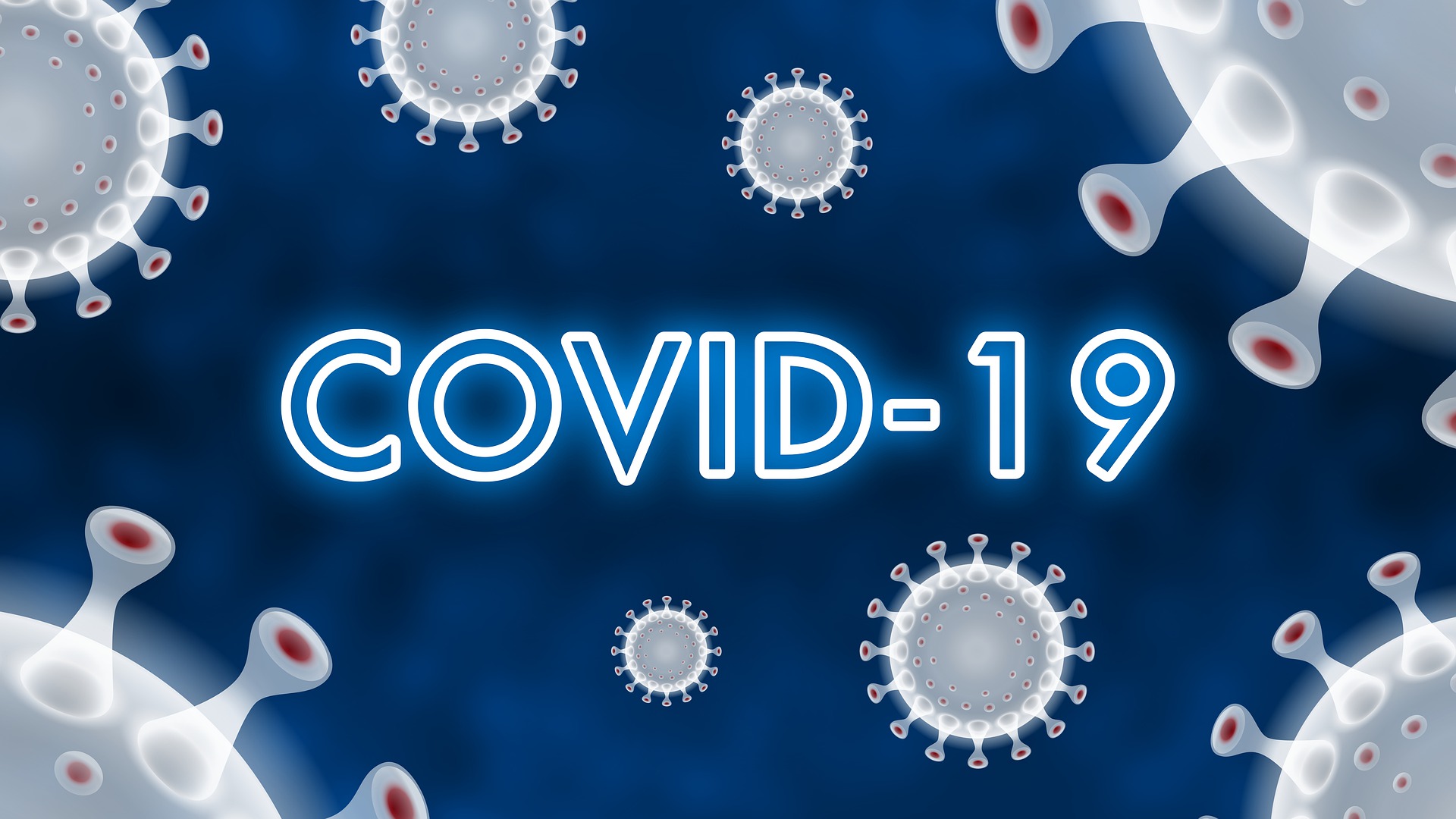

Thursday, 17th September 2020 It’s the penultimate month of the flexible furlough scheme and another change to the rules! This month sees the next grant

Tuesday, 25th August 2020 “Work from home if you can” “Go to work if you can” “Furlough” “Flexible Furlough” Which statement is right? Are you

© Copyright – Onyx Accountants | Disclaimer