Thursday, 17th September 2020

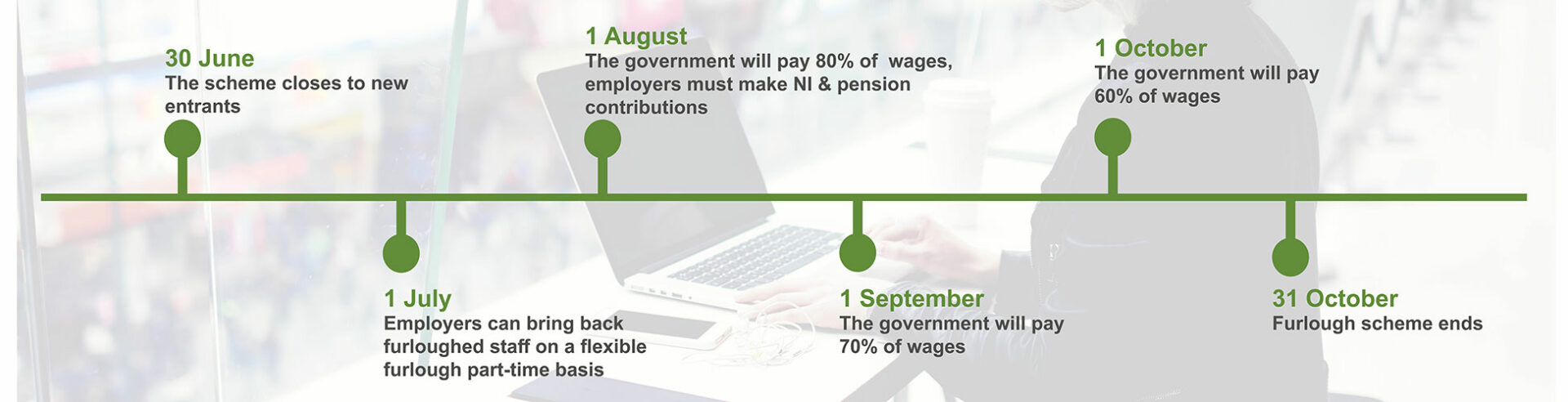

It’s the penultimate month of the flexible furlough scheme and another change to the rules!

This month sees the next grant reduction to the payroll support offered by the Government.

KEY POINTS

- Government grant will pay 70% of wages

- Grant is capped at £2,187.50

- Employers must contribute to wage costs

- October – the final month of support!

How does this affect your September payroll?

The amount covered by the government is reduced to 70% up to a wages cap of £2,187.50 for the hours the employee is on furlough.

Employers must continue to pay ER NICs and pension contributions and top up employees’ wages to ensure they receive 80% of their wages up to a cap of £2,500, for time they are furloughed.

If your pay period straddles the calendar month, then you must make a separate claim for each calendar month.

Not sure how to calculate the hours or how to process your claim in time, then give us a call!

Calculating Flexible Furlough

Flexible furlough was introduced when the old furlough scheme ended and was effective for payroll periods commencing on 1st July 2020.

To benefit from this, employers must calculate the following, for each employee:

- Usual hours worked, under normal contract (A)

- Actual hours worked (B)

- Furloughed hours worked – the difference between A and B

Usual hours can be based on a normal salaried month, or for anyone on varied or zero-hour contracts it involves looking at an average of hours worked during the 2019/20 tax year.

Pay periods that straddle the calendar month must be reported as 2 separate claims.

Have you had extreme circumstances which have meant that you have been unable to submit your claim? There are no guarantees due to the circumstances. This is new territory for us all. However, contact us now and let us see if we can help you.

Employer Contributions

Under the flexible furlough scheme Employers NI and Pension contributions will no longer be covered. All these costs must be paid by the employer regardless if the employee worked part-time or was completely furloughed.

Employers must continue to pay furloughed employees 80% of their wages up to a cap of £2,500 per month for the time that they are being furloughed.

Still baffled? Then contact us NOW! Any delay could cost you a significant amount of the CJRS grant that you may be entitled to.

October – The scheme comes to an end

During the last month of support from the Government under the Flexible Furlough Scheme the amount covered by the government will be reduced to 60% up to a wages cap of £1,875.00 for the hours the employee is on furlough.

Employers must pay ER NICs and pension contributions and top up employees’ wages to ensure they receive 80% of their wages up to a cap of £2,500, for time they are furloughed.

What happens next?

To help reduce mass redundancies and to help support employers who keep their staff on the payroll, the Government have set out a new scheme. This is called the Job Retention Scheme.

Basically, this will pay out £1,000 for each employee who had originally been furloughed, and who have continued in the same employment that they had originally been furloughed. The payment will be made directly to the employer and will be released in February 2021.

There are restrictions, there always are. Our previous article explains more. Read it HERE.

GET IN TOUCH WITH ONYX

Need help with your payroll or calculating the flexible furlough rates for your part-time staff?

Contact us now or e-mail us at enquiries@onyxaccountants.co.uk for a FREE no obligation consultation.

Got any questions or queries? Our friendly team of tax specialists are happy to help. Just drop us a line! Call us on 0121 753 5522 or 01902 759 800.

Keep up to date with the latest announcements by visiting our dedicated page https://onyx.accountants/covid/