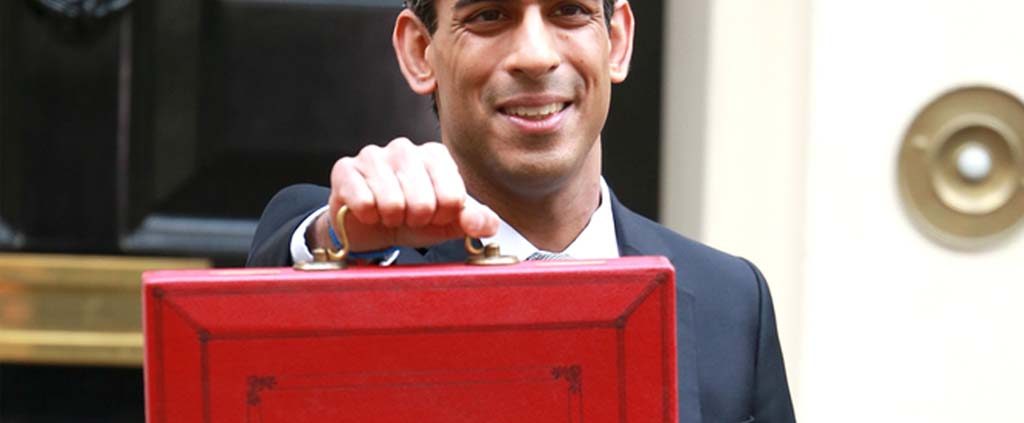

WHAT DID THE SPRING BUDGET 2022 INCLUDE?

The Chancellor touched on creating a “new culture of enterprise”. Stating that improving productivity is the only way to deliver sustainable economic growth and increase living standards. We follow what steps the government are taking to meet these commitments to growth by looking at some of the important changes to the capital allowances and R&D tax relief schemes.

This article covers the following:

- Capital Allowances plans for the future

- R&D Tax Relief Review

- R&D Claims for Data Storage

- RDEC and the SME Scheme

- How can Onyx Help

- A permanent increase of the Annual Investment Allowance (AIA) to £500,000

- Increasing the WDA rate for expenditure not qualifying for other enhanced reliefs:

- Main pool expenditure from 18% to 20%; and

- Special rate expenditure from 6% to 8%.

- Implementing an initial, larger writing down allowance in the first year at, say

- Main Pool to 40%; and

- Special Rate increasing to 13%

- the remainder to be written down at the normal rates

- Introducing a first year allowance that would be in addition to writing down allowances (rather than instead of). This could result in total deductions of more than 100% of the original cost of the asset.

- Allow “qualifying investments” of plant & machinery to be fully expensed.

- Changes to the Structures & Buildings Allowances, or other new specific reliefs.

- Expenditure on licence payments on purchasing datasets which are used directly for R&D. Staff costs incurred in processing datasets will also be eligible for the relief.

- Cloud computing costs that can be attributed to computation, data processing and software. HMRC will allow businesses to claim relief for the cost of cloud computing services used directly for R&D. For example, costs which can be attributed to computation, data processing, analytics and software.

- the storage of vital data and pure maths research.

- costs related to the storage of vital data, supporting data-heavy research such as genomic sequencing,

- additional qualifying expenditure as the government recognised the growing volume of R&D being undertaken which is underpinned by pure mathematics.