Millions of UK workers will see a drop in the pay they take home due to the National Insurance increase that was put in place on the 6th of April. With many households across the country feeling the impact of the cost of living crisis the Government announced they will increase the NI threshold to help ease financial pressure on those most affected, the increase will take place in July. But how will this affect you?

This Article covers the following points:

- How The Increase Works

- Employees: How The Change Affects Employees

- Employers: How The Change Affects Employers

- Employment Allowance Increase

- How The Change Will Affect Self-Employed

How The Increase Works

The national insurance rate has increased by 1.25 percentage points. This means that from the 6th of April workers will have seen their national insurance contributions rise from 12% to 13.25%. Earnings which are above £4,189 a month (£50,270 per year) are subject to national insurance deductions of 2%. But from the 6th of April this has increased to 3.25%. A large number of us will have to feel the brunt of the NI increase between April and June 2022. However, the threshold does increase in July which could bring some relief to households.

In the Spring Statement Rishi Sunak’s announcement of the national insurance threshold means that it will now be at the same threshold as income tax also known as the personal allowance. If you earn below £12,570 a year you will not pay income tax. Those earning more than this will still feel the benefit due to paying less national insurance overall.

Employees: How The Change Affects Employees

The change in the national insurance threshold will mean that on average each employee will save an average of £330. You can visit HMRCs National Insurance Calculator to see how the increase has affected your pocket.

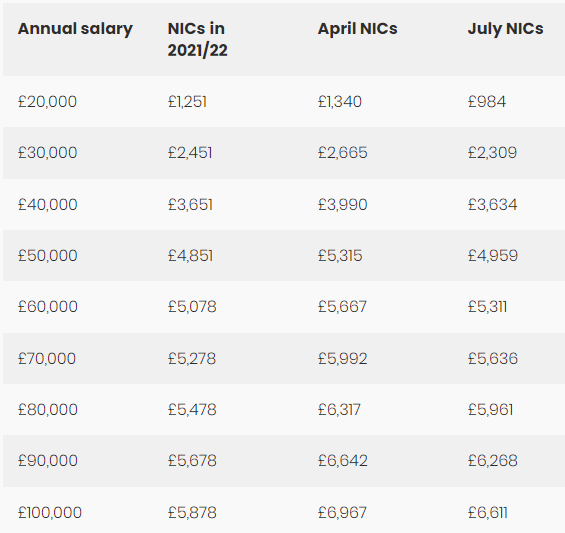

The table below outlines how the April NICs increase and the new July threshold increase will affect your annual salary. As you can see many workers will pay less NIC’s in July than they did during the 2021/22 tax year. However, if you earn more than £50,000 a year you will pay more national insurance in July than you were paying in the 2021/22 tax year.

Employers: How the Change Affects Employers

From April this year Employers National Insurance contributions increased to 15.05% for employees that are earning over £9,100 a year. Employers’ NI contributions will jump from 13.8% to 15.05%. Employers previously had to pay 13.8% national insurance contributions for most employees earning above £8,840 a year.

There are certain instances where employers won’t have to pay the extra 1.25 percentage points increase in national insurance contributions for employees, specifically:

- Apprentices under 25

- Employees under 21

- Armed forces veterans

- Employees in Freeports (areas free from certain trade taxes) on less than £25,000 a year

Employment Allowance Increase

The Government has announced that the Employment Allowance has risen from £4,000 to £5,000 – meaning small businesses will be able to claim up to £5,000 off their employer National Insurance (NICs) bills.

The Chancellor mentioned that around 94% of businesses benefitting from the £1,000 increase are small and micro businesses, and the sectors that will see the highest numbers of employers benefitting are the wholesale and retail sector (87.000); the professional, scientific and technical activities industry (63,000); and the construction sector (52,000).

Announced by the Chancellor Rishi Sunak at the Spring Statement in order to reduce employment costs, the change takes an extra 50,000 firms out of paying NICs and the Health and Social Care Levy. This increases the total number of businesses not paying NICs and the Levy to 670,000.

Note, the Employment Allowance only covers employers’ NIC contributions.

How the Change Affects Self-Employed

From April 2022, self-employed workers saw rates increase to 10.25% on profits above £9,880 and 3.25% above the same £50,270 a year. There are two different types of National Insurance, class 2 and class 4, and which class you fit in all depends on your level of earnings.

Class 2 national insurance increases your income tax bill, due by 31 January following the end of the tax year.

Your class 4 national insurance contributions are included when calculating the instalments, if you make payments on account. Otherwise, your class 4 contributions, like class 2, are also due by 31 January following the end of the tax year.

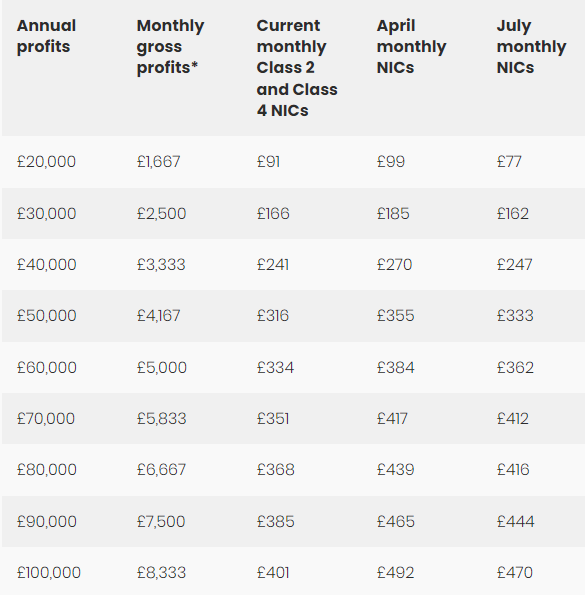

If you average out annual profits and national insurance contributions by month, please see the table below which explains how much extra you can expect to pay after April and July if you are self-employed.

GET IN TOUCH WITH ONYX

If you have any queries, or want to discuss further, please give us a call or e-mail us at enquiries@onyx.accountants for a FREE no obligation consultation.

Got any questions or queries? Our friendly team of tax specialists are happy to help. Just drop us a line! Call us on 0121 753 5522 or 01902 759 800.