Monday, 15th March 2021

On the 1st April 2021 the minimum wage will increase. This applies to both the National Minimum Wage and National Living Wage.

The National Minimum Wage (NMW) is the minimum pay per hour that most employees are entitled to by law. The rate received is based on an employee’s age and if they are an apprentice.

Rates of Pay

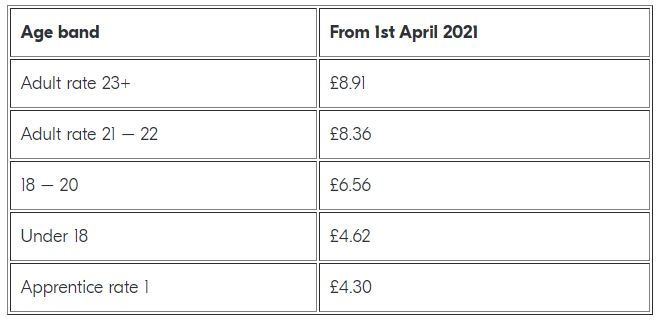

The table below shows the rates which will take effect from 1st April 2021

Minimum Wage – Requirements

To receive the minimum wage, you must be at least:

- school leaving age to get the National Minimum Wage

- aged 23 to get the National Living Wage – the minimum wage will still apply for workers aged 22 and under

Contracts for payments below the minimum wage are not legally binding. It is a legal requirement to pay the National Minimum Wage or National Living Wage.

The government has set a target for the NLW to reach two-thirds of median earnings and be extended to workers aged 21 and over by 2024, provided economic conditions allow. Based on the latest OBR forecast, this means the NLW is expected to be over £10.50 in 2024.

Are You Entitled to Receive the Minimum Wage?

Employees are also entitled to the correct minimum wage if they are:

- full or part-time

- casual labourers, for example someone hired for one day

- agency workers

- workers and homeworkers paid by the number of items they make

- apprentices

- trainees, workers on probation

- disabled workers

- agricultural workers

- foreign workers

- seafarers

- offshore workers

The minimum wage will not apply if you fit into one of the following categories:

- self-employed people running their own business

- company directors

- volunteers or voluntary workers

- workers on a government employment programme, such as the Work Programme

- members of the armed forces

- family members of the employer living in the employer’s home

- non-family members living in the employer’s home who share in the work and leisure activities, are treated as one of the family and are not charged for meals or accommodation, for example au pairs

- workers younger than school leaving age (usually 16)

- higher and further education students on work experience or a work placement up to one year

- people shadowing others at work

- workers on government pre-apprenticeships schemes

- people on the following European Union (EU) programmes: Leonardo da Vinci, Erasmus+, Comenius

- people working on a Jobcentre Plus Work trial for up to 6 weeks

- share fishermen

- prisoners

- people living and working in a religious community

Apprentices

The apprentice rate applies if you are either:

- aged under 19

- aged 19 or over and in the first year of their apprenticeship

Think you should be receiving the Minimum Wage?

If you think that you should be receiving the minimum wage, then HMRC has a helpline that is dedicated to helping and giving advice to you.

Acas provides free and confidential advice to employers, employees and their representatives on employment rights, best practice and policies, and resolving workplace conflict. The helpline has a free translation service for over 100 languages. Contact them on 0300 123 1100.

How Onyx Accountants can help you

All employers must ensure that employees are paid correctly in accordance with the law.

At Onyx we can review your workforce and advise on what minimum rates of pay should be used when calculating the payroll. With our in-house specialist payroll department, we can take away the stress of processing your payroll and manage this for you. It does not matter if you pay weekly, fortnightly, 4 weekly or monthly, the minimum rates of pay will still apply.

By using Onyx Accountants and Business Advisors to undertake your payroll processing you eliminate the paperwork, calculations and worry which allows you to concentrate on running your business.

GET IN TOUCH WITH ONYX

If you have any queries, or want to discuss further, please give us a call or e-mail us at enquiries@onyx.accountants for a FREE no obligation consultation.

Got any questions or queries? Our friendly team of tax specialists are happy to help. Just drop us a line! Call us on 0121 753 5522 or 01902 759 800.