The word ‘side-hustle’ is becoming an ever increasingly common phrase in the post-pandemic world. With employment income stretched more than ever due to the effects of a worsening cost of living crisis, people are always looking for ways to make an extra buck. Having a hobby is a great for your mental health, but having a hobby that also gives you a stream of income? Well that is just awesome! If your hobby is starting to generate you the level of income which is making you question whether or not you should be paying tax, odds are you probably should be. This article covers all you need to know about paying tax on your hobby/side business.

This Article covers the following points:

- What Is The Difference Between A Hobby And A Business?

- When Does My Hobby Income Become Taxable?

- What Is Required Of Me If I Exceed My Personal Tax Allowance?

- Claiming of Expenses

What Is The Difference Between A Hobby And A Business?

The dictionary defines a hobby as ‘an activity done regularly in one’s leisure time for pleasure’. Usually performed part-time, hobbies can be anything from making and and crafting hand-made products to selling old items at car-boot sales or online.

On the other hand, someone who is a self-employed business owner, primary focus is usually making a profit out of what they’re doing, has their own customer base, and has the ability to employ staff.

However, there is the opportunity for these two scenarios to overlap each other. This happens when the income you generates over £1000 . At this point you have exceeded the Trading Allowance, and you must now register for Self-Assessment.

When Does My Hobby Income Become Taxable?

As mentioned above, once your income exceeds over £1000 you have to register for Self-Assessment, but this doesn’t necessarily mean you will have to pay tax just yet. We all get a personal tax allowance of £12,570. Therefore if, including all other forms of income, you are earning under the personal allowance threshold, you do not have to pay tax.

What Is Required Of Me If I Exceed My Personal Tax Allowance?

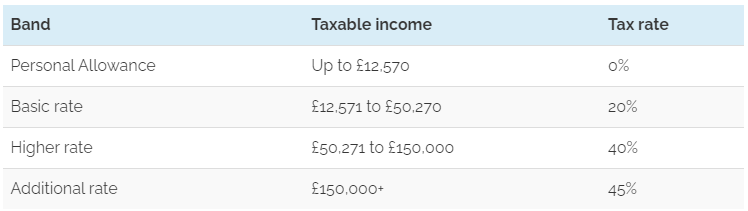

If you exceed the personal tax allowance, you will be required to pay tax on your hobby income. Please see the table below for the different tax bands depending on your income. It may be worth seeking advice from an accountant when completing your self-assessment as there may be opportunities for a more tax efficient submission you are unaware of.

Claiming Expenses

When you begin to pay tax, a way of reducing your tax bill is to claim for your expenses back. As explained in this article a percentage of your profits will be taxed. However if you’re spending a portion of that profit back on the business, for things such as supplies, it’s not considered profit in the eyes of HMRC. You can subtract the amount you have spent on expenses from your profits, and therefore reduce the amount you’ll owe in tax.

Example: A gardener charges £20 to cut someone’s grass. The gardener spent £5 buying the petrol for his mower. This means that the gardener has made £15 in profit. They will pay income tax (at 20%) on the profit. The gardener will therefore pay income tax on £15 (£3 tax) rather than on the full £20 (£4 tax). In some cases this difference can be really very significant!

GET IN TOUCH WITH ONYX

Do you have a hobby you feel you are ready to take the next step with and start a business? Unsure of the next steps to take? Maybe you are still unclear on whether or not you should be paying tax on your profits, or maybe you need some help with self assessment. If you have any queries, or want to discuss further, please give us a call or e-mail us at enquiries@onyx.accountants for a FREE no obligation consultation.

Our friendly team of tax specialists are happy to help. Just drop us a line! Call us on