New VAT penalties and interest charges

The two distinct new late filing and late payment penalty regimes replace the current default surcharge regime, which currently applies to both the late submission and late payment of VAT.

The new VAT penalties and interest charges apply for VAT return periods starting on or after 1 January 2023.

Failures relating to returns for periods starting before 1 January 2023 will be dealt with under the default surcharge regime and old interest rules.

This article is going to cover the following points:

- Late Filing Penalties

- Penalty Points

- Late Payment Penalties

- First Penalty Charge

- Second Penalty Charge

- Late Payment Interest

- Repayment Interest

Late Filing Penalties

Under the points-based late filing penalty regime:

- a taxpayer will receive a penalty point, if they miss a VAT return filing deadline;

- a taxpayer will be charged a £200 penalty for each failure to file on time, once a specified number of points is accrued; and

- the number of points required for a penalty to be charged depends on the filing frequency of the VAT returns (two points for annual returns, four points for quarterly returns and five points for monthly returns).

Penalty Points

If a person fails to file a VAT return on or before the due date, the person is liable to one penalty point.

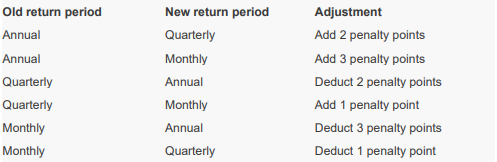

A person will not be charged a penalty point for a return, if the person has already reached the threshold number of penalty points. If the frequency of a person’s filing obligations changes, the person’s penalty points total will be adjusted as follows:

A points total will never be adjusted to less than zero.

A penalty point generally expires 24 months from the first day of the month after the month in which the failure giving rise to the penalty point was awarded.

When a taxpayer is at the points threshold, all the points accrued within that points total will generally be reset to zero when the taxpayer has:

- met their return obligations for a set period; and

- has submitted all the submissions, which were due in the preceding 24 months (whether or not those submissions were on time).

Late Payment Penalties

The late payment penalty regime comprises two penalty charges.

A first late payment penalty is calculated on amounts outstanding on day 15 and day 30.

A second late payment penalty is calculated on amounts outstanding from day 31 until the VAT is paid in full.

Penalties will stop accruing, if the taxpayer agrees a Time To Pay (TTP) arrangement with HMRC.

No penalty charge is due if the VAT due is paid in full up to 15 days after the due date. Or the person contacts HMRC up to 15 days after the due date with proposals for paying the VAT and, as a result, a TTP arrangement is made (whether before or after the 15-day period).

First Penalty Charge

A first penalty is payable if:

- the VAT due is not paid in full up to 15 days after the due date; and

- a TTP agreement has not been made as a result of a proposal to HMRC up to 15 days after the due date.

If the VAT due is paid in full, or a TTP proposed, after 15 days of the due date but within 30 days after the due date, the first penalty is calculated at 2% on the amount outstanding at day 15.

If the tax due is not paid in full and a TTP has not been proposed up to 30 days after the due date, the amount of the first penalty is:

- 2% of the amount outstanding at day 15; and

- 2% of the amount outstanding at day 30.

Second Penalty Charge

Where VAT is outstanding 31 days after the due date, a second penalty is payable, calculated at a daily rate based on 4% per annum, on the remaining VAT liability until it is paid in full or, until the date proposals are received for a TTP which results in an agreement with HMRC.

The second penalty is calculated when the VAT is paid.

Late Payment Interest

HMRC will charge late payment interest from the day a VAT payment is overdue, until the day it is paid in full. Late payment interest will also be charged on late filing and late payment penalties not paid within 30 days.

Interest is charged at the Bank of England base rate plus 2.5%*.

Repayment Interest

HMRC will pay repayment interest (RPI) on any VAT due to be repaid to a

taxpayer.

RPI is calculated from the later of:

- the day after the due date; and

- the date of submission,

until the date a repayment is issued.

Repayment interest is calculated at the Bank of England Base rate minus 1%*, or if higher 0.5%*.

For more information on VAT and the new VAT penalties and interest charges please visit the GOV website.

*rates correct at the time of publishing this article

GET IN TOUCH WITH ONYX

Do you have a VAT query? Our tax team are on hand to help if you have any queries regarding information in this article, or want to discuss further, please give us a call or e-mail us at enquiries@onyx.accountants for a FREE no obligation consultation.

Our friendly team of tax specialists are happy to help. Just drop us a line!

Call us on 0121 753 5522 or 01902 759 800. We look forward to hearing from you!