The claim window for the Fifth SEISS Grant is closing soon. The deadline for making a claim is 30th September 2021. This will be the final grant given to the self-employed. If your business has suffered due to Covid or as a result of the pandemic restrictions you must consider this grant.

We have covered this grant previously and included details of how this final grant will be calculated. The link is HERE >>>

Who is the grant for?

In a nutshell – if you are self-employed and your business has continued to suffer as a result of the coronavirus then this is for you!

Each individual must meet HMRC’s eligibility criteria – all three stages!

Stage 1 – You must be a self-employed individual or a member of a partnership. Tax returns must have been completed for both the 19/20 and 20/21 tax year. Trading through a limited company or a trust does not qualify.

Stage 2 – Your 19/20 tax return must have been submitted by 2nd March 2021 and have trading profits of no more than £50,000. HMRC will consider previous years if you do not qualify based on trading profits.. The amount of non trading income, e.g. rental income, pensions and savings, must not be greater than your trading income.

Stage 3 – You must be continuing to trade into the 21/22 tax year. AND with reason – believe that your trading profits will be significantly affected by Covid during the period from 1st May 2021 and 30th September 2021.

Making a reasonable assessment differs from business to business. Therefore, HMRC have provided meaningful guidance on how you can assess if your business has been affected. Follow this link to find out more Eligibility for SEISS Grants.

How much will you get?

The Fifth SEISS Grant is calculated differently from the previous SEISS grants.

When making the claim, HMRC require actual turnover figures which cover the tax year period and NOT your accounting period. For example, this applies to those who have a year end different to either 31st March or 5th April.

Turnover figures must be provided for the following:

- April 2020 to April 2021; and

- either 2019 to 2020; or 2018 to 2019

HMRC have provided a guide to explain how to calculate your turnover figures. Click here Turnover Guide.

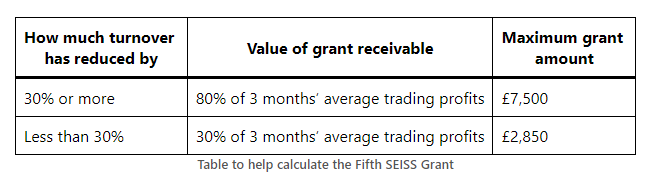

These turnover figures are then compared to calculate how much your turnover has reduced by in the 20/21 period when compared to the previous year(s).

Trading profits are taken from the previously submitted tax returns. HMRC will calculate this for you and will look at the last 4 tax years. This will depend on when your self-employment started, therefore the end calculation will be modified accordingly.

Your trading profits are then averaged to calculate a value for 3 months. For example if your average profits were say £50,000 then 3 months worth will be £12,500.

- Then if your turnover was reduced by more than 30% – you will receive £12,500 x 80% = £10,000, therefore this will be capped to £7,500.

- However, if your turnover was reduced by less than 30% – you will receive £12,500 x 30% = £3,750, therefore capped at £2,850

The amount you receive will all depend on your trading results from the previous tax years.

Making the claim

The claims window for the Fifth SEISS Grant closes on 30th September 2021.

All claims must be made directly on the HMRC website, by logging into your self-assessment tax account. You must submit your claim yourself. Your accountant or tax advisor cannot do this on your behalf.

When you claim you will also need:

- Self Assessment Unique Taxpayer Reference (UTR)

- National Insurance number

- Government Gateway user ID and password

- UK bank details including account number, sort code, name on the account and address linked to the account

You may also have to answer a few security questions depending on your account and circumstances.

The grant, once approved by HMRC should reach your bank account within 6 working days. An e-mail will be sent to confirm this.

HMRC have also advised that if the previous tax returns are amended after the SEISS grants have been claimed then you should notify HMRC within 90 days. You may need to repay some of the grant already received.

Reporting the income

Each of the SEISS grants received are taxable and subject to self-employed national insurance contributions. This grant must be reported on your 2021-2022 Self-Assessment tax return.

The grant also counts towards your annual allowance for pension contributions. SEISS grants are not counted as ‘access to public funds’ and you can claim the grant on all categories of work visa.

How Onyx Accountants Can Help You

Do you know if you are eligible for the Fifth SEISS Grant? Maybe you are unsure how much of the grant you might receive.

At Onyx Accountants and Business Advisors, we have a dedicated team of Tax Specialists and Advisors. Self-Assessment is all they talk about! We are experts in reviewing previously submitted tax returns, accounts preparation and understanding HMRC’s tax rules! So let us do all the hard work leaving you to run your business.

GET IN TOUCH WITH ONYX

If you have any queries, or want to discuss further, please give us a call or e-mail us at enquiries@onyx.accountants for a FREE no obligation consultation.

Got any questions or queries? If you have then our friendly team of tax specialists are happy to help. Just drop us a line! Call us on 0121 753 5522 or 01902 759 800.